- |

- Business

- Compare Exchange Rates

- |

- |

- Reviews

- |

- Help

- |

- Contact Us

- |

- Blogs

- |

- Currency Converter

A bank account has several purposes other than keeping your money. Hence, before you plan to move to any foreign country, you must open a bank account there.

The UK is no exception to this rule. However, in the olden days, it used to be exceedingly challenging to open a bank account in the UK for a non-resident. Thankfully, things have become a little bit simpler due to the advent of modern technology.

If you are planning to relocate to Great Britain and want to open a bank account before you move, keep reading.

The following steps will give you a detailed idea about opening an account in Britain.

You will require two types of documents to open a UK bank account:

1. Identification proof

You can prove your identity by providing documents like:

A passport

Driving license

Identity card (this only applies if you are an EU national)

2. Address proof

The essential documents considered as acceptable proof of address are:

An apartment lease or mortgage statement

A recent gas or electricity bill, no older than three months

A current (less than three months old), physically printed bank or credit card statement

Recent council tax statement

Evidence that you are a student (this can be the admission letter from your university, the UCAS confirmation, or your student visa)

A "bank letter" from the university attesting to your enrollment, your UK home address, and your international address

There are various bank accounts available in the UK, and you can choose the one that best meets your needs. The most common ones are:

1. Savings Account

The majority of banks offer a variety of savings and investment choices under the savings accounts category.

Depending on the account type, these accounts may have minimum deposit requirements and holding periods. But they offer greater interest rates overall.

2. Current Account

These are the most traditional and widely used in the UK to fulfil daily necessities like paying bills, shopping, and getting paychecks.

Current accounts come with a debit card and are usually free or inexpensive (premium accounts will cost more). Furthermore, it typically provides choices like credit cards and overdraft capabilities.

Most banks provide unique variations of these accounts to the younger demographic.

3. Basic Account

Many UK banks provide free basic bank accounts to individuals with a low credit score or who struggle to get a current account.

You would not be able to use credit cards, borrow money, or overdraw your account with these. Still, they provide essential services and products like Visa Electron debit cards and direct debit payment choices.

When you start a basic account, you can typically upgrade to a current account if your circumstances change and you satisfy the credit check requirements.

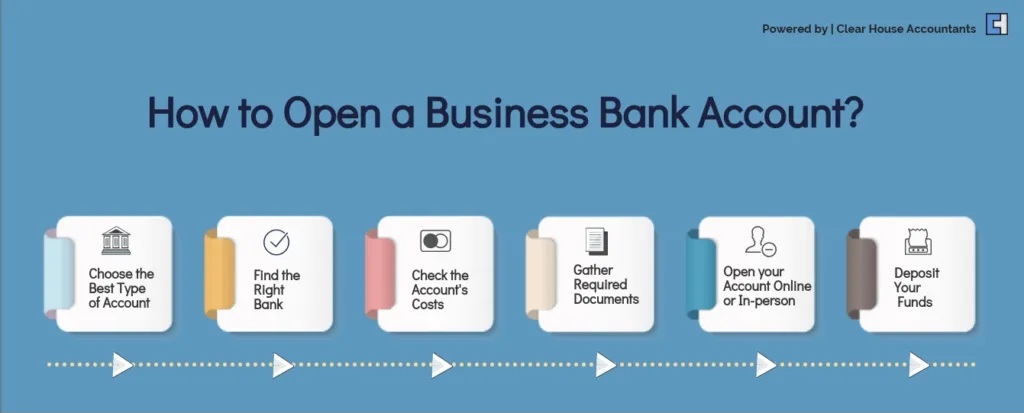

4. Business bank account

You can set up a business banking account with any of the major banks in the UK if you're planning to open a business.

Freelancers and unlimited sole traders/partnerships typically need to present proof of identity for each partner, along with proof of both their personal and business addresses.

Limited companies must also give their Company Registration Number, all directors' information, and an annual revenue estimate.

5. Offshore Accounts

Opening a foreign offshore bank account may be the most effective option for expats residing in the UK to manage their funds.

While working or residing abroad, opening an international offshore account in the UK is feasible.

Offshore accounts accept GBP, EUR, and USD deposits and typically have a higher minimum balance requirement than traditional bank accounts. They provide benefits to domestic banks, like favourable tax policies.

The choice of your bank determines the kind of facilities you will enjoy as an account holder.

You can compare offers from different banks in The UK to choose your ideal institution. If you are an expat wishing to open a bank account in the UK, you further need to see which financial institution has a substantial online presence. This is because, as a foreigner, you are most likely to open an account before arriving in the UK.

Here are some established banks you will find in Britain:

1. Lloyds

Lloyds Bank is one of the biggest retail banks in the UK and offers about eight current standard accounts. Among these, the account, namely basic, classic, student, and under-19, are gratuitous.

Moreover, the financial institution offers platinum accounts with insurance benefits and credit interest choices for approximately £19 per month. Two additional international account options are available for non-residents and those who require access to foreign markets.

These allow for free foreign money transfers. However, opening an account requires a minimum annual income of £25,000.

2. Metro

Metro Bank is a comparatively smaller and recent UK bank with about 67 locations across the nation. Its branches are open seven days a week, and you don't need an appointment to speak with an advisor. The bank's main selling point is its accessibility.

UK citizens can open a standard current account for free, which comes with privileges including free cash withdrawals abroad. There are also accessible simple cash accounts. However, the account options are more constrained for foreigners.

3. Royal

The Royal Bank of Scotland plc is a significant retail and commercial bank in Scotland. Along with NatWest (in England and Wales) and Ulster Bank, it belongs to the NatWest Group's retail banking subsidiary.

The Royal Bank of Scotland has about 700 locations, most of which are in Scotland, although there are also locations throughout England, Wales, and many larger towns and cities.

It also offers multiple other options that you can compare with the help of the internet. Once you find the bank of your choice, all that is left is to apply there for an account with all the required documents discussed above.

Apart from the above mentions things, you can also check other aspects of opening an account to further benefit yourself.

The following things can make you unnecessarily lose money on baseless demands made by certain banks. Some of these are:

1. Associated Fees

There may be additional costs for certain services or add-ons, even though many UK accounts are free of monthly fees. For example, most banks might charge you pay a certain amount to transfer money internationally.

Do not give in to their demands just because it seems convenient. Instead, look for other alternatives available in the market. Sticking to the example mentioned before. You can make international payments at competitive rates from The Currency Club.

We maintain complete transparency and only charge a nominal margin over the interbank exchange rates.

2. Incentives

Many banks may use incentives like cash deposits or interest-free periods to entice consumers, so browse to see what is available.

Moreover, a non-sterling transaction fee, which can be as high as 2.99% per transaction, is frequently imposed by banks. Some banks may add a cash withdrawal fee to the non- sterling transaction fee.

It can take quite a while (up to four or five weeks) to open an account because of the stringent security requirements associated with the banks. Having adequate cash on hand to pay for your expenses during this time is crucial.

Use this blog as your guide to open an account in the United Kingdom and ease your stay there. Always remember that every facility and bank account type is designed to aid a certain group of individuals. Hence, never select one randomly and always conduct a thorough check.

This blog outlines how to open a bank account in the UK.

A lot depends on the type of bank account you choose to open.

You should also wisely select the bank to get better services.

You learn how certain financial institutions charge incentives and associated fees for services like international money transfers and other non-sterling transactions.

We have made every effort to ensure that the information published here is correct and accurate, however you should check and confirm the latest exchange rates with The Currency Club directly prior to making a decision. The information published is general and does not consider your personal objectives, financial situation or particular needs. Full disclaimer available

A page for us to share with you our thoughts on everything to do with with foreign exchange and much more. From new product launches and widgets to political announcements, market insights and even where to head on your next holiday look no further, you'll find it all here.

March 2022

There can be multiple reasons for which you would need to send money abroad. Be it to pay for an item, to buy a property or just transfer money to a loved one.

Read More

October 2020

As a new year begins and the January blues sets in, many will return to their desks attempting to tackle their backlog of emails but at the same time distracted by which destination they should escape to next..

Read More

December 2020

According to Mintel research, 43% of holidaymakers used a debit or credit card last year and this seems to be on the rise with the 30-45 year age group.

Read More